The Government of Canada says it is committed to helping Canadians during the COVID-19 pandemic and has now announced a new set of economic measures to help stabilize the economy in the country.

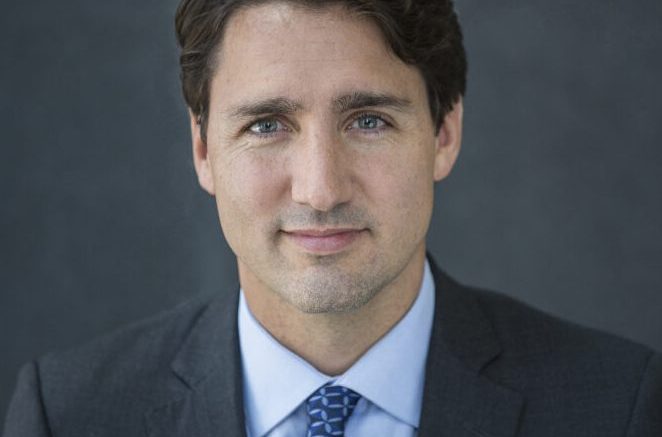

Prime Minister Justin Trudeau made the announcement Wednesday as part of the Government of Canada’s COVID-19 Economic Response Plan.

The plan will provide up to $27 billion in direct support to Canadian workers and businesses.

Another $55 billion will be set aside to help business liquidity through tax deferrals, bringing the total of the plan to $82 billion.

The total represents three per cent of Canada’s Gross Domestic Product (GDP).

“No Canadian should have to worry about paying their rent or buying groceries during this difficult time,” Trudeau said in a news release. “That is why we are taking the strong action needed to stabilize our economy and help those impacted by the COVID-19 virus. Together, we will get through this difficult time.”

The emergency aid plan includes:

Support for workers

Trudeau says Canadians should not have to worry about paying their rent or mortgage or buying groceries because of the COVID-19 crisis. To support workers and their families, here are some details of the government’s plan.

- Introduce an Emergency Care Benefit of up to $900 bi-weekly for up to 15 weeks to provide income support to workers who must stay home and do not have access to paid sick leave. This measure could provide up to $10 billion to Canadians.

- Provide additional assistance to families with children by temporarily boosting Canada Child Benefit payments. This measure would deliver almost $2 billion in extra support.

- Provide $305 million for a new distinctions-based Indigenous Community Support Fund, to address immediate needs in First Nations, Inuit, and Métis Nation communities.

- Provide an additional $157.5 million to address the needs of Canadians experiencing homelessness through the Reaching Home program.

Support for businesses

In the face of an uncertain economic situation and tightening credit conditions, Trudeau says the Government is taking action to help affected businesses. Here are some of the announcements the government has made to help businesses during the Covid-19 pandemic.

- Launch an Insured Mortgage Purchase Program to purchase up to $50 billion of insured mortgage pools through the Canada Mortgage and Housing Corporation (CMHC). As announced on March 16, this will provide stable funding to banks and mortgage lenders and support continued lending to Canadian businesses and consumers.

- Increase the credit available to small, medium, and large Canadian businesses. As announced on March 13, a new Business Credit Availability Program will provide more than $10 billion of additional support to businesses experiencing cash flow challenges through the Business Development Bank of Canada and Export Development Canada

- Allow all businesses to defer, until after August 31, 2020, the payment of any income tax amounts that become owing on or after today and before September 2020. This relief would apply to tax balances due, as well as installments, under Part I of the Income Tax Act.

- Augment credit available to farmers and the agri-food sector through Farm Credit Canada.

“These are extraordinary times and we must take extraordinary measures,” Bill Morneau, Minister of Finance said in a news release. “The Government of Canada will do whatever it takes to ensure that the health of Canadians is protected, families and businesses are supported and our economy remains strong, even in the face of uncertainty. I am working with the financial sector, the Bank of Canada, my provincial and territorial colleagues, and my counterparts from around the world to keep coordinating on significant actions to protect the Canadian and global economy. Canadians can rest assured that we are ready to take all necessary measures to meet the challenges ahead.”

To view the Government of Canada’s COVID-19 Economic Response Plan in full click here.

arthur.green@cklbradio.com

Twitter.com/artcgreen

Arthur C. Green is from Whitbourne Newfoundland and graduated from the CNA Journalism Program. Arthur also studied Business Marketing and Political Science at Memorial University in Essex England and St. John's Newfoundland. Green has worked as a spot news photographer/journalist with such news organizations as Vista-radio, CBC, CBC Radio, NTV, Saltwire and Postmedia in Alberta.